Take out taxes calculator

Connecticut recognizes same-sex marriages for income tax purposes so keep that in mind when filling out your W-4. The combined tax rate is 153.

How To Calculate Federal Income Tax

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

. For all filers the lowest bracket applies to income up to 25000 and the highest bracket only. Using the United States Tax Calculator is fairly simple. The money also grows tax-free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially.

Rates range from 0 to 399. Next select the Filing Status drop down menu and choose which option applies. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Ad The IRS contacting you can be stressful. Use this tool to. Your household income location filing status and number of personal.

On March 23 2017 the Saskatchewan PST as raised from 5 to 6. Your average tax rate is 1198 and your. First enter your Gross Salary amount where shown.

As a 1099 earner youll have to deal with self-employment tax which is basically just how you pay FICA taxes. The IRS redesigned some of the Form W-4s guidelines in recent years. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Some deductions from your paycheck are made. For starters all Pennsylvania employers will. Massachusetts Income Tax Calculator 2021.

See where that hard-earned money goes - Federal Income Tax Social Security and. Taxes Paid Filed - 100 Guarantee. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

Need help with Back Taxes. How to calculate annual income. It can also be used to help fill steps 3 and 4 of a W-4 form.

Tax rate for all canadian remain. See how your refund take-home pay or tax due are affected by withholding amount. If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667.

Taxes Paid Filed - 100 Guarantee. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Current HST GST and PST rates table of 2022.

Free tax code calculator. See the article. The state tax year is also 12 months but it differs from state to state.

Some states follow the federal tax. Check your tax code - you may be owed 1000s. Payroll So Easy You Can Set It Up Run It Yourself.

For example if an employee earns 1500. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Ad Try Our Free And Simple Tax Refund Calculator.

Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. Reduce tax if you wearwore a uniform. 100 Accurate Calculations Guaranteed.

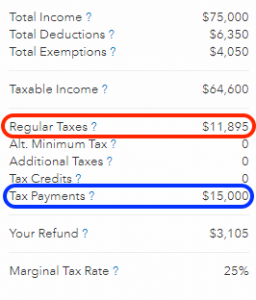

How It Works. Estimate your federal income tax withholding. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

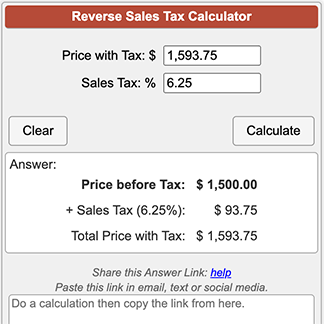

Start with a free consultation. Transfer unused allowance to your spouse. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737.

Ad Easy To Run Payroll Get Set Up Running in Minutes. We work with you and the IRS to settle issues. Normally the 153 rate is split half-and-half.

Ohio has a progressive income tax system with six tax brackets. Without the help of a paycheck calculator its tricky to figure out what your take-home pay will be after taxes and other monies are withheld. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Paycheck Calculator Online For Per Pay Period Create W 4

Payroll Tax Calculator For Employers Gusto

How To Calculate Payroll Taxes Methods Examples More

Payroll Tax What It Is How To Calculate It Bench Accounting

Tax Withholding For Pensions And Social Security Sensible Money

How To Calculate Withholding Tax A Simple Payroll Guide For Small Business

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Tax Withholding For Pensions And Social Security Sensible Money

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Tax Withholding For Pensions And Social Security Sensible Money

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Reverse Sales Tax Calculator

2022 Income Tax Withholding Tables Changes Examples

Florida Paycheck Calculator Smartasset

How To Calculate Payroll Taxes Methods Examples More